Build Real Valuation Skills That Matter

Most analysts struggle with DCF models because nobody shows them the messy reality. We teach valuation the way it actually works in practice, not just theory from textbooks. You'll work through real financial statements and build models that actually get used.

View Our Programs

Three Approaches We Actually Use

Forget the academic fluff. These are the methods that work when you're sitting across from a CFO trying to justify your numbers.

Discounted Cash Flow

Everyone talks about DCF, but most people build overly complex models that fall apart. We focus on getting your assumptions right and building models that withstand scrutiny.

- Start with historical performance patterns

- Build realistic revenue projections

- Calculate WACC that makes sense

- Test sensitivity across scenarios

Comparable Company Analysis

Finding the right comparables is harder than it looks. You need companies that actually match your target's business model and growth stage, not just the same industry code.

- Screen for genuine comparables

- Adjust multiples for differences

- Understand when to use EV ratios

- Account for market conditions

Precedent Transactions

Past deals tell you what buyers actually paid, which often differs from theoretical value. But you need to dig into deal terms and market timing to use this method effectively.

- Find relevant transaction data

- Adjust for deal premiums

- Factor in market timing

- Consider strategic vs financial buyers

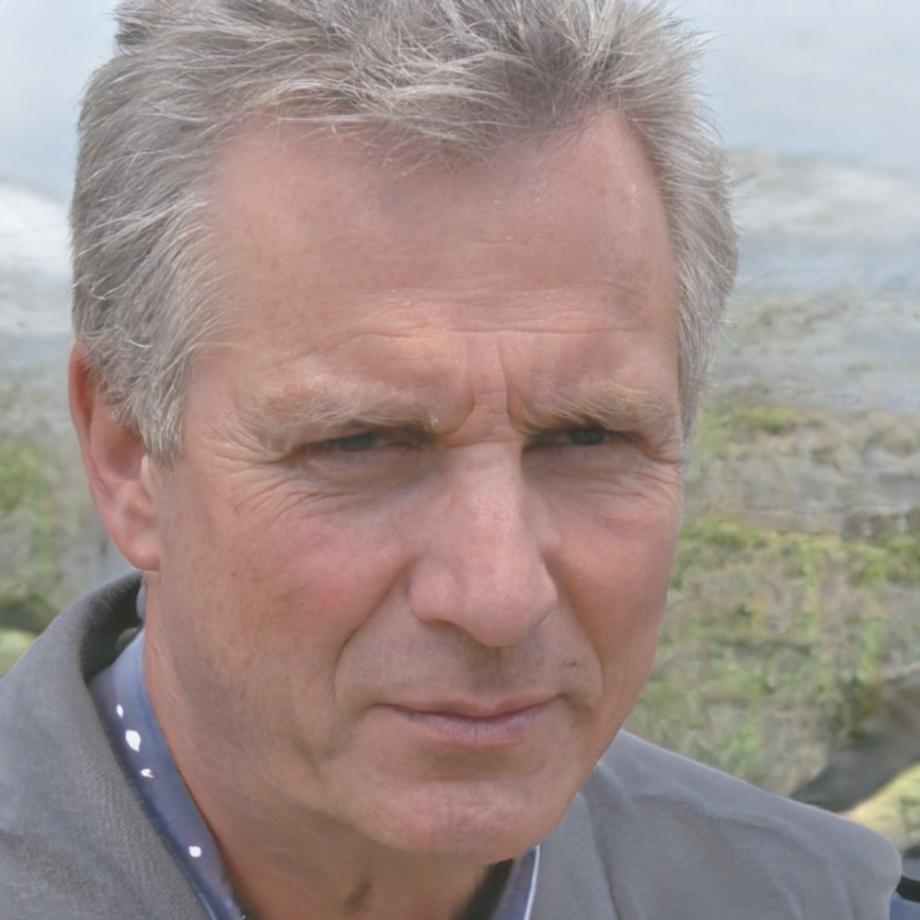

Dr. Henrik Bjornsen

Lead Valuation Instructor

I spent twelve years doing equity research before moving into teaching. My specialty was consumer goods companies, which meant dealing with messy retail data and unpredictable consumer trends. The models I built had to survive quarterly earnings calls and investor presentations.

What I learned is that valuation is more about judgment than formulas. You need to understand business models deeply enough to know which assumptions really matter. A small change in terminal growth rate might be critical for one company but irrelevant for another.

When I teach, I start with actual company financials and walk through the analysis step by step. We debate the assumptions. Students often catch things I miss, which is the point. Valuation should be a rigorous process, not a formula you plug numbers into.

Background

- PhD in Finance, Stockholm School of Economics

- Former equity analyst at Nordea Markets covering retail sector

- Published research on valuation methodology in emerging markets

- Currently serves on advisory board for two Taiwanese fintech startups

Next Program Starts September 2025

We run intensive programs twice a year with limited enrollment. The autumn session begins in September and runs through November. Classes meet twice weekly in the evenings to accommodate working professionals.

Program Details

Applications for the September cohort open in June 2025. We review applications on a rolling basis and typically fill spots by mid-July. Priority goes to candidates with relevant work experience who can contribute to class discussions.